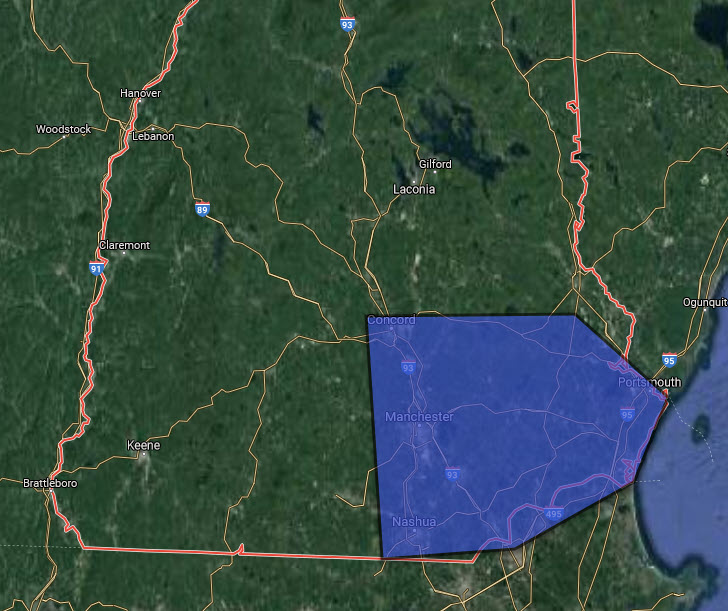

NH Homes Sales Lowest Since 2011

December 7, 2023 *Source: NH Union Leader & NHAR Market Data Today, the NH Union Leader reported that Single-Family Home Sales in NH are the

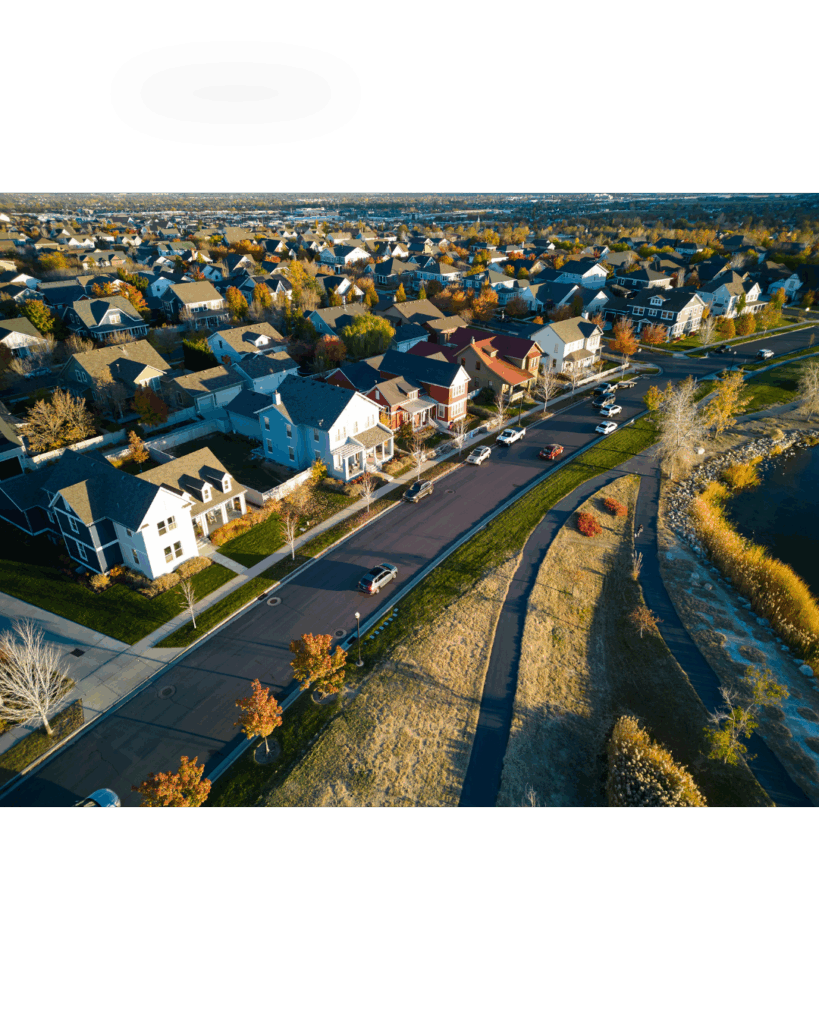

We plan and build residential communities designed for long-term value, efficiency, and modern living across New Hampshire.

From land evaluation to final build, we deliver comprehensive development solutions tailored for long-term

community growth.

Zoning analysis, land studies, and project viability assessments.

Master planning, architecture coordination, and community layout.

Zoning, environmental reviews, and municipal coordination.

Managing timelines, materials, builders, and project execution.

Roads, water, drainage, and community systems planning.

Preparing the community for sale, marketing, and long-term value.

We collaborate with landowners, investors, builders, and local partners to deliver high-value, well-planned residential communities.

1

You connect with us to discuss your land, goals, and development vision. We assess feasibility and outline the best path forward.

2

We conduct studies, prepare plans, and coordinate with architects, engineers, and local officials to shape a compliant, high-value development strategy.

3

We oversee timelines, materials, partners, and construction to ensure the project is completed efficiently and positioned for long-term value.

December 7, 2023 *Source: NH Union Leader & NHAR Market Data Today, the NH Union Leader reported that Single-Family Home Sales in NH are the

April 17, 2023 From the Desk of our Team Leader: I am very excited to share with you that Northern Properties Realty Group donated a

Getting frustrated with losing in bidding wars on homes? Adopt these 7 tips to spice your offers up and make them more attractive to sellers.

A good rule of thumb is to have at least 10% of the cost of the home saved for a down payment, separate from any savings accounts or emergency funds you have. Better yet, if you can manage to put between 15%-20% down, you won’t need to worry about the private mortgage insurance (PMI) requirement.

Buying a home is a smart investment, which can actually help you save money in the long run. Any time you spend money on your home, you’re investing in yourself and increasing your home’s potential return-on-investment (ROI), should you decide to sell down the road. Renting, on the other hand, secures your living space, sometimes at a lower monthly payment compared to a mortgage, and often covers the responsibility of maintenance and repairs. We believe, whenever possible, it’s better to pay yourself by paying a mortgage versus paying a landlord rent that you, essentially, can’t get back or otherwise capitalize on.

Here’s a great formula to use when it comes to determining your home-buying budget: it’s the 28% / 36% rule. Basically, you shouldn’t max out more than 28% of your monthly income on home-related costs, while 36% of that income should cover all other debts, like your car payment, credit cards, student loans, and your mortgage.

Your monthly mortgage payment covers four factors: insurance, interest, principal, and taxes.

Although you don’t need a real estate agent to buy a house, by partnering with one you’ll likely save yourself some serious headaches down the road. Realtors offer specific home buying expertise that covers industry rules and regulations, as well as legal issues you might not be familiar with. By partnering with a realtor when you’re ready to buy a home, you’re not only playing it safe but also accessing inventory that might not be on the market yet.

Generally speaking, the closing process requires a closing agent — sometimes referred to as an escrow or settlement agent. This person organizes the signing of all relevant documents between the buyer and seller, upholds the terms of the purchase agreement and disburses the funds, which includes transferring the title and recording the deed. Your realtor will work with you to ensure that you are prepared for the closing with all the paperwork you need, including any associated closing costs.

Let our team evaluate your site, outline opportunities, and guide you through the development process with clarity and proven insight.